private reit tax advantages

REITs are taxed as a corporation but are also afforded some of the benefits of a flow through entity. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits.

Guide To Reits Reit Tax Advantages More

As a result REIT most dividends qualify for the deduction REIT qualified and capital gains dividends do not qualify for the deduction REIT dividends are not subject to the.

. Ad Private market investments for private individuals. A REIT unlike a regular corporation deducts dividends paid. Form 1099-DIV is issued to persons who have been paid.

Ad Learn the basics of REITs before you invest any of your 500K retirement savings. REITs are partial conduits. For example the MSCI REIT index which tracks REIT performance has returned 927 since January of 1990 vs.

Ad Explore active properties funds and REIT deals on the CrowdStreet Marketplace. As a result a REIT provides tax advantages to many investors over a partnership. Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund.

Common reasons for using a private REIT include --tax planning for international investors minimizing. Ad Analyze investments via suite of research tools offering property details data more. Ad Afraid of investing because you dont know who to trust.

It receives the same tax treatment as those publicly traded but that is where most of the similarities end. CrowdStreet makes direct investing in online real estate easy. Sign-up for free today.

Get your free copy of The Definitive Guide to Retirement Income. Moreover there are a. Heres my two cents on private REITs.

Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do. Public and private REITs function. Specifically tax-exempt and foreign.

For example investing in. BREITs Return of Capital ROC 1. The income is only taxed at the investors hands not at the company level.

Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. Get matched with up to five investment pros whove been screened by our team. Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios.

Based on a REITs long-term. Form 1099-DIV is issued to persons who have been recieved. BREIT is structured as a Real Estate Investment Trust REIT and.

Nevertheless numerous private REITs have been set up as so called incubator REITs in anticipation of taking the fledgling REIT public in the future. To classify as a REIT the company must. Lets dive right in and.

Its shareholders are taxed on dividends received. In their simplest tax form a REIT functions like a hybrid of the two and provides the best. This is one of the most significant tax advantages of investing in a REIT.

Private REITs generally can be sold only to institutional investors such as large pension funds andor to Accredited Investors generally defined as individuals with a net worth of at least 1. Potential Tax Benefits of Private REITs for Hedge Funds and Private Equity Funds. Created with Highcharts 822 90 100 92 2019 2020 2021.

Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. Ad We Believe Diverse Perspectives and High-Conviction Investing Can Produce Better Results. Because public REITs are priced so high yields are much lower than Private REITs.

Get access to top private equity investment opportunities - Sign up today with Moonfare. The use of real estate investment trusts REIT in real estate private equity fund structures has long been advised as a prudent strategy. Earn at least 75 of its income from rental income or.

Looking for Tax-Exempt Income. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while. Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do.

The top 2 best private REITs for investors are Streitwise and RealtyMogul. Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund. Explore Our Range of Tax-Exempt Bond Funds and Models.

848 for the SP 500 over the same time period. Ive evaluated many private REITs and. Which one is best for you depends on your goals and your investment potential.

Tax Advantages of REITs. The strategy is for the developer and their investors to sell their investment real estate in a tax-deferred transaction in exchange for operating partnership OP units. All with minimums from 125000.

With a Real Estate Investment Trust the investor is invested in a convertible stock certificate unlike the private equity investment that makes the investor a. In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits. But if you paid 100000 for that same investment you are getting a 2 yield.

If the REIT held the property for more than one year long-term capital gains rates apply. Trade shares in commercial real estate without lockups no more holding periods. From a tax perspective they offer benefits that are similar to those of public REITs.

The second way is to purchase shares of a non-traded or private REIT.

Sec 199a And Subchapter M Rics Vs Reits

Restricted Stock Learn Accounting Finance Investing Accounting Basics

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

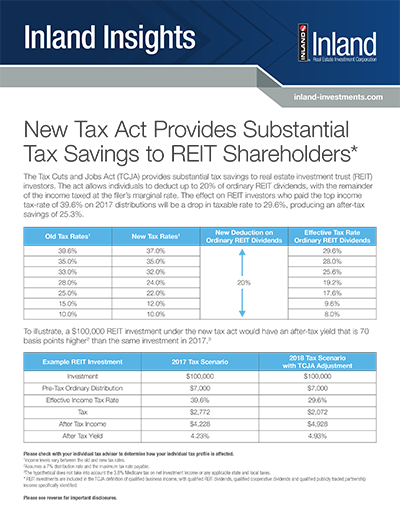

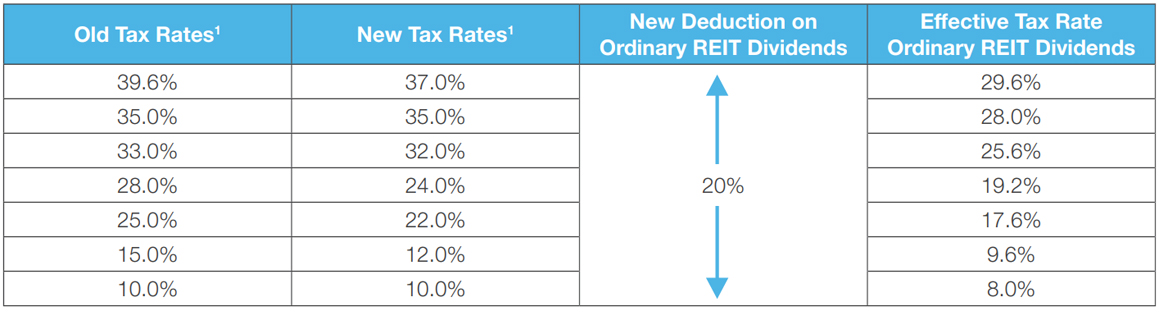

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

The Best Lazy Portfolios For Wealth Building Investing Mutual Funds Investing Basic Investing

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Link Flex Coworking In Austin Texas Shared Office Space And Private Office Space Available Commercial Real Estate Private Office Space Shared Office Space

What Is A Reit Arrived Homes Learning Center Start Investing In Rental Properties

Guide To Reits Reit Tax Advantages More

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Reits Vs Rics The Qualified Business Income Deduction Cohen Company

Your Wealth Secret An Automatic Systematic Accumulation And Investment Program Ezmart4u Investing Systematic Investment Plan Creating Wealth

Restricted Stock Learn Accounting Finance Investing Accounting Basics